Contents

As for the working timeframe, formally, the system is applicable for any period. But I find it undesirable to go below H4 – the number of false signals is increased on lower timeframes from my experience. The Alligator is asleep – the lines are intertwined and have no slope; when the Alligator lines are flat, no trend trading is conducted as the market is deemed to be ranging. Depending on the position of the lines, the state of the market can be determined and with the help of additional filters, trading opportunities can be identified. A simple script in order to plot the Alligator Indicator with triangles plotted on the graph in order to see directly if the alligator is sleeping or eating.

A moving average is a technical analysis indicator that helps level price action by filtering out the noise from random price fluctuations. The indicator applies convergence-divergence relationships to build trading signals, bittrex review with the Jaw making the slowest turns and the Lips making the fastest turns. The Lips crossing down through the other lines signals a short sale opportunity while crossing upward signals a buying opportunity.

The trend has already begun, the chart is adjusting, and the Alligator lines have just started to diverge. When the Alligator is pretty full and has lost interest in the food, it closes its mouth . Some traders at this point will close their positions if they’ve made a profit, as the uptrend or downtrend may have come to a standstill i.e. the market is becoming range bound. The most important part of the Bill Williams Alligator is when the 3 lines are mixed together. This is when the Alligator is considered to be sleeping and no trading signals are present.

What is Donchian Channel indicator (Trading Strategy)

The ranging markets depicted by the sleeping Alligator suggests periods where traders can stay away from the markets and avoid taking undue risk. This is one of the fundamental differences with the Alligator indicator compared to other trading indicators. Not many indicators shift the periods into the future which could give some understanding into what price will be doing. To enter a trade based on the Alligator and Fractals, you need to wait until the Alligator wakes up. Next, after the Alligator has awakened and started opening the mouth, you put an order at the breakout of the nearest fractal. The fractal must be above or below the Alligator teeth, depending on the trade direction.

.jpeg)

If you are looking to trade forex online, you will need an account with a forex broker. If you are looking for some inspiration, please feel free to browse my best forex brokers. I have spent many years testing and reviewing forex brokers. IC Markets are my top choice as I find they have tight spreads, low commission fees, quick execution speeds and excellent customer support.

You should of course set stop loss and take profits according to your money managament principles. I would always try to ensure that I only take trades which present a favourable risk to reward ratio. The Alligator indicator, also known as the Williams Alligator indicator, is a technical analysis tool developed by Bill Williams. It consists of three moving average lines that converge or diverge according to the state of the trend.

Let me explain how to trade with Bill Williams’ bitfinex review. The best timeframes to trade the Alligator are D1, H4, H1. Once you have customized the Alligator Indicator to your liking, click ”OK” to apply the changes and close the properties window.

What Is The Alligator Indicator & How To Trade With It

With the lips and the teeth separating from the jaw, the Alligator has completely opened the jaw and started feeding. In this post, you will learn what Alligator indicator is, how it works, how to use it in your trading, and the tools you can combine with it for a better result. This exposes a significant drawback of the indicator because many awakening signals within large rangeswill fail, triggering whipsaws. Third stage is when three lines close above and below the price, meaning Alligator is awakened and hungry.

This is available also on the MT4 trading platform which is widely used. Another example from the above chart is the support and resistance levels. For example, after the support level was established, you can see the strong trend that pushed prices to the next resistance level.

- See New Trading Dimensions by Bill Williams, PhD. Bars are green when the Awesome Oscillator and Accelerator/Decelerator are both positive.

- You can think that the Alligator is a complete trading strategy, but it is not so.

- As the trend power decreases and eventually comes to an end, the balance lines come closer together.

If it has been sleeping for longer than the preceding phase where it’s eating, we can assume a likely profitable trend. Trading software can be expensive, but some platforms feature built-in charting tools right within the trading dashboard. The Alligator is as much a metaphor as it is an indicator. Three lines make up the indicator, overlaid on a pricing chart.

The Alligator indicator was created by Bill Williams, an American trader, and psychologist. Williams described the Alligator indicator in his book ‘Trading Chaos’ in 1995. Self-confessed Forex Geek spending my days researching and testing everything forex related. I have many years of experience in the forex industry having reviewed thousands of forex robots, brokers, strategies, courses and more. I share my knowledge with you for free to help you learn more about the crazy world of forex trading!

What Is The Williams Alligator Indicator?

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

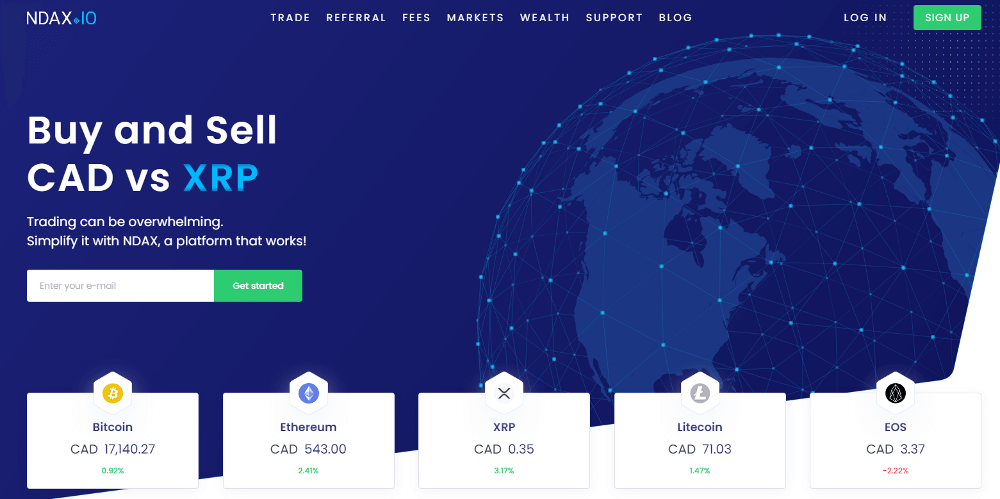

Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading. There may be many different combinations between Alligator and other tools of technical analysis. We research technical analysis patterns so you know exactly what works well for your favorite markets.

What Are The Advantages of Using The Alligator Indicator?

It is used to spot the entry points in slow trends or in conservative trading strategies when traders prefer to trade only in the strongest levels/zones. Alligator is composed of three smoothed lines, which Williams called lips, teeth, and jaws. These lines imitate the process of an alligator’s hunting. The lines are moving averages with different periods and shift to the future.

If the line is broken out, the trend is likely to change. The Fractals indicator looks like an arrow above the Japanese candlestick up or below the candlestick down on the chart. Open the chart of any trading instrument in the LiteFinancePersonal Profile. To begin with, let’s consider the classic use of the Alligator without using other analysis tools. Each of the groups describes a certain state of the market at the current moment.

Closing the position manually

Although the Alligator indicator helps, the rules in using it are a bit vague. Therefore, it is necessary to test the indicator using a virtual account before using it, to know when to enter the market at the right time. Also, it’s to be noted that there’s no such thing as the Holy Grail indicator in trading. All indicators have their shortcomings and shouldn’t be used alone or without other confirmations. We can see in the left section of our EUR/USD chart above indicated by the ellipse where all three lines all closed together. This means that the Alligator is sleeping or is tired — implying that the market is not doing anything and that we should wait for the start of a new trend.

Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators. Alligator indicator is a technical analysis tool that uses smoothed moving averages. Taken together, the lines form the “mouth” of a hungry alligator, ready to hunt for inexperienced traders and other market participants who trade against major players. Note that at the first stage, Alligator sleeps, and the three smoothed moving averages are at the same point.

You can see that he also gave creative names to the indicator and its elements. His idea was to provide an example that will demonstrate the behavior of the market. This example is the alligator that alternates between the periods of sleep and hunting. Alligator’s Lips – 5-period smoothed moving average which is moved 3 bars into the future. Alligator’s Teeth – 8-period smoothed moving average which is moved 5 bars into the future. Alligator’s Jaw – 13-period smoothed moving average which is moved 8 bars into the future.

As with any trading strategy, it is vital that you test it, lay out a trading plan, and ensure risk management is priority one. Trading the financial markets is not as easy as many make it out to be. The Cryptocurrency trading for beginners lips of the Alligator, the green line, is the fastest moving average and will be the first one a trader will want to monitor. You want to see the green line cross both of the slower moving averages.