Contents

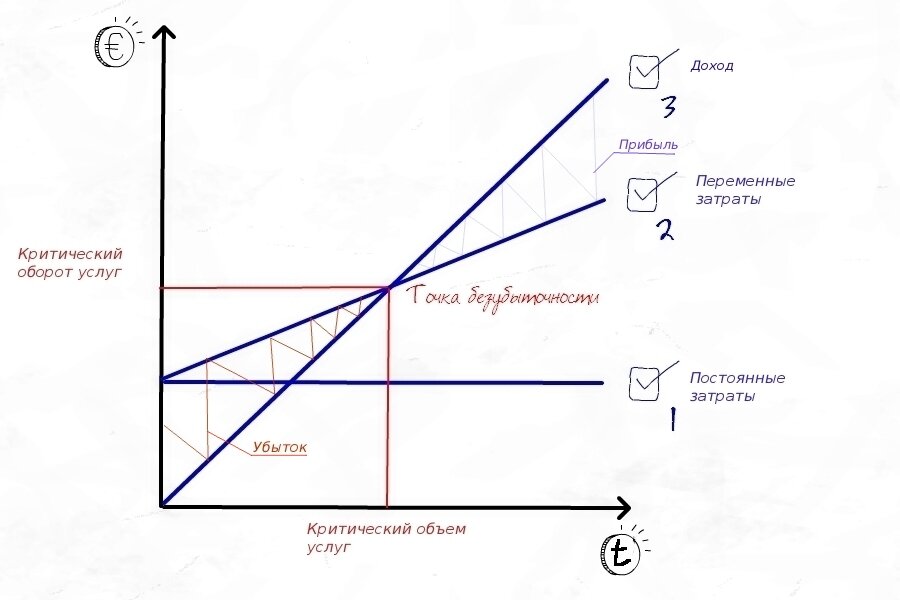

By using the built-in ABCD indicators, we were able to identify this geometric pattern with two Fibonacci rules. The BC line is 61.8% retracement level of the AB line. Moreover, the CD line is the 127% extension level of the BC line. The bullish pattern surfaces in a downtrend and signals a potential reversal.

Each turning point represents a significant high or significant low on a price chart. These points define three consecutive price swings, or trends, which make up each of the three pattern “legs.” These are referred to as the AB leg, the BC leg, and the CD leg. The ABCD pattern is easy to spot in various markets, in any market condition, and on any timeframe.

With this example, you have the CD forming a perfect bear flag pattern. You would take the stock or ETF short on the breakdown, as seen below, placing your stop above the most recent high inside the pullback. The pattern is often used to predict a trend continuation or a trend reversal depending on where your entry is taken.

For both the bullish and bearish versions of the ABCD chart pattern, the lines AB and CD are known as the legs while BC is called the correction or retracement. ABCD pattern trading is something every day trader needs to have in their arsenal. And it is far and away the most consistent pattern because it’s rooted in market fundamentals. When time, price and shape all manifest in a stock chart in the form of an ABCD pattern, it’s a good indicator for making a smart trading decision. We recommend using these levels together with support and resistance you identify at the chart using various tools of technical analysis. Don’t forget to have a look at senior timeframes when you hunt for support and resistance levels.

After a Strong Start, the Latest FAANGs Earnings Were Disappointing

For both versions, the lines AB and CD are called the legs while BC is known as the retracement or correction. When shares make a new high then you want to look for resistance for a possible short entry. In strongly trending markets, BC may only be 38.2% or 50% of AB. Do you know if you do better with long or short trades? Identify your strengths and weakness as a trader with cutting-edge behavioural science technology – powered by Chasing Returns.

It can be used for https://business-oppurtunities.com/s in both bearish and bullish trends and gives the information necessary to avoid heavy losses. The ABCD pattern is a highly recognizable value pattern that happens in stocks across the globe every day. The main recognizable feature of an ABCD pattern is that the A to B leg matches the C to D leg — in other words, AB ≈ CD. The B to C leg meanwhile, represents pullbacks and consolidation of value. These patterns can go both ways and can thus be bullish or bearish. Depending on which it is, the investor will either buy or sell at the D point.

Due to its overall structure, traders look for the highs and lows when trading the ABCD pattern. Moreover, a useful way to trade the pattern is to combine it with the zig-zag indicator. The indicator can draw price highs and lows, so traders can easily spot the ABCD pattern. Each pattern has both a bullish and bearish version. Bullish patterns help identify higher probability opportunities to buy, or go “long.” Bearish patterns help signal opportunities to “short,” or sell.

Low Volume on Consolidation

There actually are some signs that can hint that CD will be much longer than AB. They are a gap after point C or big candlesticks near point C. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Discover the range of markets and learn how they work – with IG Academy’s online course. Following the initial drop from point A to B, the price rebounded to point C.

Depending on the trajectory of the swing, you’ll choose a point of earnings on forex after the stock breaks after the high. Remember to take suitable steps to manage your risk, like setting up a stop order to limit your loss. Ross Cameron’s experience with trading is not typical, nor is the experience of traders featured in testimonials. Becoming an experienced trader takes hard work, dedication and a significant amount of time. Once you have identified a very clear buy signal on your chart, the only thing left to do is to watch for a breakout. If volume breaks out at the same time the price does, that is a much stronger signal than a price breakout with low volume.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Learning and spotting chart patternsin the stock market is a popular hobby amongst day traders of all skill levels.

Bear and bull power indicators in forex measure the power of bears and bulls to identify ideal entry points. Access our latest analysis and market news and stay ahead of the markets when it comes to trading. Since equal AB and CD distances are one characteristic feature of the pattern, a trader may enter a buy trade, thinking that point D has been located. However, the price may fall substantially lower if the actual ABCD pattern forming is characterized by the C to D distance being approximate 161.% longer than the A to B distance.

Any statements about profits or income, expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. Self-confessed Forex Geek spending my days researching and testing everything forex related. I have many years of experience in the forex industry having reviewed thousands of forex robots, brokers, strategies, courses and more.

When trading reversals with the ABCD, its standing as a harmonic indicator requires that guidelines for completion of retracements and legs be established. A directional move in pricing represents a significant bullish or bearish change in asset valuations. Directional moves are commonly referred to as “legs” and may be quantified on any duration chart, from one minute to yearly. As a general rule, a directional market is in the midst of a trend. Users can manually draw and maneuver the four separate points .

The possibility that the pattern may generate a false trading signal is the biggest downside. The bullish version of the pattern, which signals the end of an existing downtrend, is simply the bearish version flipped upside down. The ABCD bearish version has three ascending price swings before a trend reversal occurs. At first, the pattern begins with a price increase from A to B.

Trading with the ABCD pattern

The pattern is then followed by a reverse and rise in price, known as BC, which is then reversed to a bearish move , completing the pattern. Once the price completes the CD price swing, there is a reversal and an increase in the price once the price touches point D. Since each pattern has both bearish and bullish versions, they help identify opportunities to buy and sell. Bullish patterns help identify more significant opportunities to buy, and bearish patterns help identify higher selling opportunities. A disadvantage of trading the ABCD pattern is the potential disadvantage common to all technical indicators.

- Bear and bull power indicators in forex measure the power of bears and bulls to identify ideal entry points.

- Stop Loss is set just below point D, and the landmarks for profit-taking are points C, A, and above if there is a strong upward movement.

- AUDUSD has been hit pretty strong by the news that popped up an hour ago, USD getting more and more strengh as it showed more inflation than expected.

- When played correctly, you can take an entry after the candle closes and put your stop below the hammer handle.

- The higher the volume on the breakout, the better the odds are of it working.

Then, once the C to D portion of the move is complete, it often signals a bearish reversal. From A-B and C-D bulls are pushing the stock higher and higher with aggressive demand. It is also why the consolidation in C produces a higher low. More aggressive traders will initiate a short sell trade very near point D, with an initial stop-loss order placed a bit above point D. More conservative traders will wait for further confirmation of a trend change shown by prices falling below point C before making a short entry into the market.

ABCD pattern rules

Since their appearance in 1935, many patterns have undergone some refinement. The inclusion of Fibonacci ratios and projections have added more detail to the specifications. This was one of the primary goals of this article — to shed some light on the perfect ABCD pattern. Set stop-loss below point C, if the price goes below C then sell and accept the loss gently (don’t seek revenge).

What is the AB=CD Candlestick Pattern?

Trade thousands of markets including Luft, EUR/USD, Germany 40, and gold. Trade Bitcoin, Ethereum and Litecoin and more cryptocurrency CFDs. Commissions from 0.08% on global shares & extended hours on 70+ stocks.